- HEALTH INSURANCE CLAIMS PROCESS FLOW DIAGRAM SOFTWARE

- HEALTH INSURANCE CLAIMS PROCESS FLOW DIAGRAM LICENSE

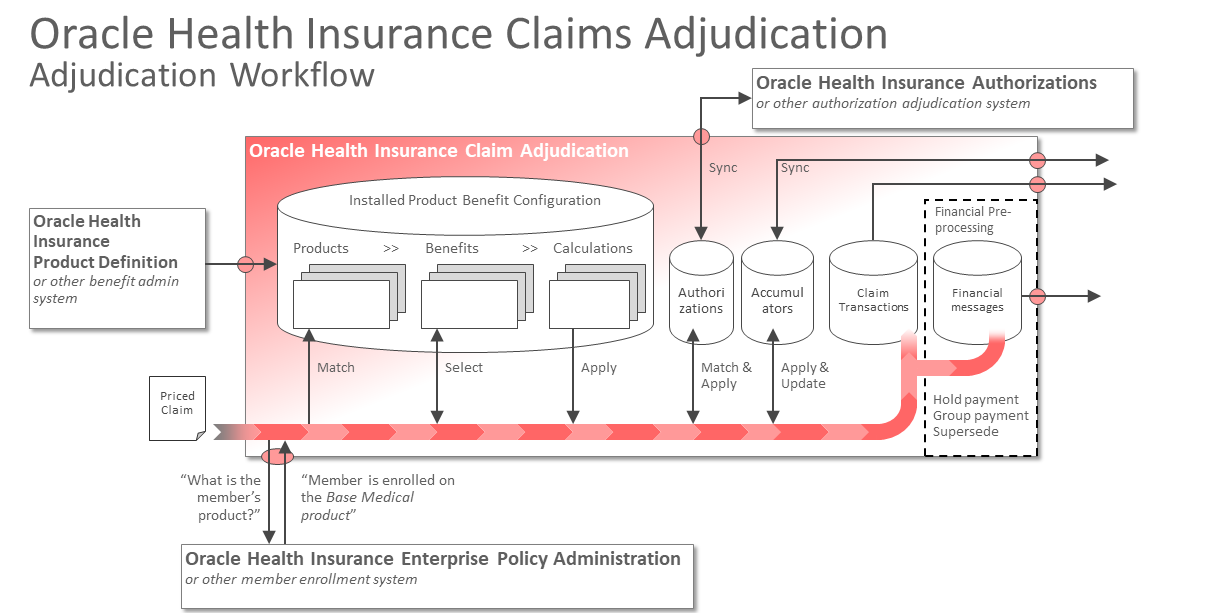

Biller’s will also include the cost of the procedures in the claim. The medical biller takes the superbill from the medical coder and puts it either into a paper claim form, or into the proper practice management or billing software.

HEALTH INSURANCE CLAIMS PROCESS FLOW DIAGRAM SOFTWARE

Once complete, the superbill is then transferred, typically through a software program, to the medical biller. This information is vital in the creation of the claim. This includes the name of the provider, the name of the physician, the name of the patient, the procedures performed, the codes for the diagnosis and procedure, and other pertinent medical information. The superbill contains all of the necessary information about medical service provided. This report, which also includes demographic information on the patient and information about the patient’s medical history, is called the “superbill.” Once the patient checks out, the medical report from that patient’s visit is sent to the medical coder, who abstracts and translates the information in the report into accurate, useable medical code.

Copayments are always collected at the point of service, but it’s up to the provider to determine whether the patient pays the copay before or immediately after their visit. The provider’s office will also collect copayments during patient check-in or check-out.

HEALTH INSURANCE CLAIMS PROCESS FLOW DIAGRAM LICENSE

The patient will also be required to provide some sort of official identification, like a driver’s license or passport, in addition to a valid insurance card. When the patient arrives, they will be asked to complete some forms (if it is their first time visiting the provider), or confirm the information the doctor has on file (if it’s not the first time the patient has seen the provider). Patient check-in and check-out are relatively straight-forward front-of-house procedures. If the patient’s insurance does not cover the procedure or service to be rendered, the biller must make the patient aware that they will cover the entirety of the bill. Certain insurance plans do not cover certain services or prescription medications. Insurance coverage differs dramatically between companies, individuals, and plans, so the biller must check each patient’s coverage in order to assign the bill correctly. Once the biller has the pertinent info from the patient, that biller can then determine which services are covered under the patient’s insurance plan. Confirm Financial Responsibilityįinancial responsibility describes who owes what for a particular doctor’s visit. If the patient is new, that person must provide personal and insurance information to the provider to ensure that that they are eligible to receive services from the provider.

If the patient has seen the provider before, their information is on file with the provider, and the patient need only explain the reason for their visit. When a patient calls to set up an appointment with a healthcare provider, they effectively preregister for their doctor’s visit. These steps include: Registration, establishment of financial responsibility for the visit, patient check-in and check-out, checking for coding and billing compliance, preparing and transmitting claims, monitoring payer adjudication, generating patient statements or bills, and assigning patient payments and arranging collections.īear in mind that there is a difference between “front-of-house” and “back-of-house” duties when it comes to medical billing. Like medical coding, medical billing might seem large and complicated, but it’s actually a process that’s comprised of eight simple steps.

0 kommentar(er)

0 kommentar(er)